How not to have it’s credit card cloned all the time

About 2 weeks ago, during an online transaction, my credit card was cloned. Bbelieving that my experience could be beneficial for you, dear readers, I called my bank, the National Bank, to find out how not to have it’s credit card cloned. Here is the resume of my discussion with Jean-François Léveillé, credit cards head of retail product manager team at National Bank of Canada.

[spacer height = “20px”]

I must say that my adventure is far from simple. I have a single credit card, being an entrepreneur all my transactions are done on the latter and I do not have a back-up. Whether it’s hosting payments, emails, creative software, transit card, my daily and personal purchases, and so on. everything is on the same map. In short, it’s not fun when it happens. I have to count myself lucky because no amount has been put on my credit card, the credit card service of the National Bank of Canada / Mastercard having been fast enough to disable my card for online purchases. It’s still pretty boring when it comes to two weeks of Christmas. But I prefer that transactions were made on my card illegally.

[spacer height = “20px”]

Here is the essence of the interview with Mr. Léveillé to know how not to have it’s credit card cloned before the holidays

[spacer height = “20px”]

So, Mr. Léveillé, first of all, I must congratulate you on the speed of the computer services that, in the minutes following the transaction, which I believe triggered everything, quickly canceled my card for online transactions. In fact, what are the best ways to protect yourself online and offline?

[spacer height = “20px”]

First, offline, because this is where most cases of fraud happen, you have to hide your PIN, it’s something smart phones and watches help to reduce anyway. Speaking of the PIN, you have to change it regularly. Another thing you forget is in the office, sometimes you leave your credit card on your desk in a common workspace (especially with the new spaces at the WeWork or open spaces without closed offices). ) we must always keep it with us, not in his drawer or on his desk, with us. For the holiday season, avoid leaving it in the glove compartment of the car, it is often the first place that thieves look for offense.

[spacer height = “20px”]

New National Bank of canada Mobile App

[spacer height = “20px”]

The online shopping

In terms of online transactions, we advise people to do their transactions on reliable sites such as Apple or Amazon for example and to avoid less known sites. We advise people to check the address of the site to know that it is really authentic. One way to know that the address is good is to type it directly in the browser (Safari, Chrome, Explorer, etc.). Way better than clicking on a link in an email.

[spacer height = “20px”]

New Transactional Website of National Bank of Canada

[spacer height = “20px”]

Another way is to check online transactions, it is possible on the website of the National Bank. If you check your transactions regularly, it’s more likely that you’ll see suspicious transactions than if you’re waiting for your statement at the end of the month.

[spacer height = “20px”]

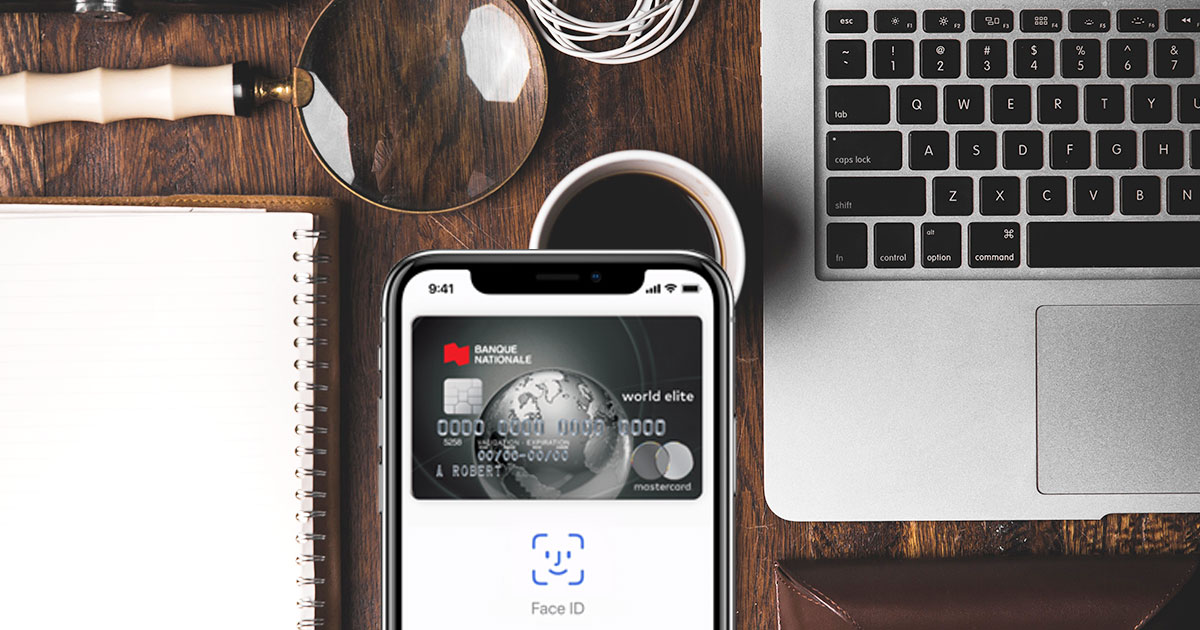

How not to have it’s credit card cloned with the new technologies

Also, I know that we use a lot of new technologies (paypass, TouchID / FaceID with Apple for example). Is it safe or it is better to take the card directly with the PIN when possible ?

[spacer height = “20px”]

Apple Pay / Google Pay Payment

[spacer height = “20px”]

The electronic medium is just as secure as the card. What we must be careful about is the merchant as such. That is to say, the terminal that you use at the merchant is a terminal that is mobile or fixed. In restaurants for example, make sure you always have your credit card in your field of vision. Does the server go with your card to clone it on a ghost terminal and bring back your card after? Technology is no more dangerous, but what we advise you is to monitor your phone at all times.

Interac Flash from National Bank

[spacer height = “20px”]

What precautions to take?

As I said earlier, at National Bank, it was extremely fast. As long as I believe the transaction was completed and that I got the message and the call. Do you have special precautions? I know you can not tell us everything for security reasons, but, is there mechanisms that are triggered? What is the process that makes a transaction suspicious?

[spacer height = “20px”]

There are indeed mechanisms of protection and detection of fraud. They are robots, basically, that scan all transactions in the portfolio and they have risk indicators. So at this point it is “flagged” by the systems. There is a contact that is made with the cardholder to verify whether it is a legitimate transaction or not. To answer the question, yes, there are systems that are exposed to these transactions and that detect, in a preventive way, a possibility of fraud, phishing or other.

[spacer height = “20px”]

Our goal is to protect customers. We do not want them to pick up with purchases they have not made, in a stressful situation, where their credit rate is affected. Our primary goal, as I said, is to protect the customer beyond the own protection mechanisms that the client must take himself. Above that, we add an additional layer of protection to make us feel comfortable and safe using this method of payment.

[spacer height = “20px”]

More credits cards, more security?

Are there ways to protect ourselves? Like having two credit cards, for example, as an entrepreneur, would that be something to look at?

[spacer height = “20px”]

You raise two points. First, it is with your accountant that you must check what is more used to follow personal accounting versus business accounting. So yes, from this perspective there may be an advantage to having two cards, it will make the work of the accountant easier for the different statements. Second, the transaction mode is protected and secure. So if you use the same card, it’s always the same protection that applies. There is no need to have a distinction card for online transactions and for physical transactions. If you have two credit cards, you have twice the risk (card cloning, etc.). The risk is increased by the number of products you hold. And as there are securities, you have experienced it yourself, the same protection mechanisms apply.

[spacer height = “20px”]

A last tip?

It’s really interesting, and I know your schedule is busy with the holiday season, one last tip to finish?

In times of big purchases, we become excited, we must keep a cool head, it is still a credit tool. So what we recommend is to be more vigilant. Change the PIN, check transactions regularly online. Just to avoid having a fraud, keep the card on oneself, do not leave it at work and not in the car. If we are more discreet with our transactions, thieves will look less. So hide his bags in his car. Discretion, vigilance, and if you see something suspicious, contact your bank, we are here to help you.

[spacer height = “20px”]

Thank you so much for his advice on how not to have your credit card cloned!

[spacer height = “20px”]

P.S. I received my new card a week after the suspension of mine. Thank you National Bank and Mastercard.

Don’t hesitate to use your credit card to become a member of Le Club by Gentologie or to buy one of our magazines.